Its my second wk of training. And this is my first rant from the newbie. If your going to loose money you better make sure you have learned something. I traded 20 stocks today, 15 positive, 5 negative. Although this might look well its wasn’t, position and size was way to unrealistic in the 5 stocks I traded badly. I did not wait for my levels using the pivots. I did not build into positions, I bought my projected full position in one trade. When I saw it going poorly, I did not go flat. I set no stop point in my mind as to what level was I prepared to exit. Instead I fought the data and tried to dollar cost avg in. I must of thought I was investing today instead of trading.

Another thing I noticed were the 15 stocks I traded well were bought at great levels and I had exit levels in my head. Do not get complacent, 3 good days in a row, followed by a bad day can just be that, or it can break you. Do your home work the night before, be ready in the opening market with clear cut projections of what you want to do and do it. Going back to basics for tomorrow.

Category Archives: Trading

Always learn something from your mistakes.

Technically And Figuratively Speaking

Technically, the S&P is overbought based on RSI and Stochastics.

Figuratively, nobody gives a damn.

For reasons I can’t explain, I want to short this market with every fiber of my being. And I do early on every day, until around 3pm. Then I buy futures and cover some of my shorts. I also sprinkle in a few long oil names like HAL or XOM. And every day that trades pays off. I don’t know why, and I don’t care. I ask Dean, my partner and PM, as well as every trader on our desk the same thing each day. Why shouldn’t I make this trade? Has the market done anything differently in the last 2 weeks? The answer is in the positive P&L during that period.

I have not made any substantial money during these last 2 weeks. It took me a while to figure out just how little this market cares about being overbought. It took me a while to take the path of least resistance. Its never too late to make the right trade.

Where are we headed?

There is no direction in this market. Tod the spooz traded in a tight range. Both our longs and shorts worked for us. As we take a look at the bigger picture and evaluate the broader market, we have no evidence of a big move. There are plenty of questions that still need answers such as; where are rates headed, what will happen in Egypt, will there be anymore quantitative easing. With these unanswered questions ahead of us, one would speculate we will eventually pullback. For the time being we still remain to grind higher. But when the pullback comes, it will come fast and hard. Take a look at our CEO Jeremy Frommer’s blog; 10 Reasons The Stock Market is Delusional, for further conviction of a pullback.

Putting the Math in Your Favor

Ahhh the sweet smell of success. Today I finished the session with a P&L of $380, my best performance in weeks. Lately, my trading has been characterized by excessive losses, heartbreaking whipsaws, and general lack of discipline. I made a promise to myself to change my wily ways and get back on the path to righteousness. In order to do so, I first had to identify the factors that were contributing to my demise. Looking back over my scorecards, I noticed a disturbing pattern; my losses had become humongous while my gains remained minuscule. I bore the scarlet letter; the whole town knew I was nothing but a dirty, no-good amateur. From a psychological perspective, it is easy to understand why this hallmark plagues so many traders. When a position moves in an unfavorable direction, many traders tend to add into the trade believing a reversal looms on the horizon. When the ever expanding position continues to trend, the pain eventually becomes too great to bear and the trader pukes. Conversely, when a trader begins to make money on a position, the natural inclination is to book profits for fear that the stock will reverse its course. This mindset creates a portfolio full of robust losing positions and meager winners.

Recognizing the perils of this traders’ paradox I sought shelter from its relentless clutches. I recalled a guiding principle I learned in my very first week at Hedge Fund Live; putting the math in your favor is the only assured way to consistently make money. In order to accomplish these ends, one must constantly control his or her reward to risk ratio by only risking a fraction of what one is willing to make on any particular trade. The most effective way to control one’s risk to reward ratio is to control one’s share sizing. If I noticed a losing position was larger than other winning positions, I immediately took down risk. Furthermore, I allowed my winning trades to run in my favor for longer than I normally would. Using this strategy I was able to finish the day with a pad of 6 winners and 1 loser with my largest winner coming in at $140 and my only loser costing me ($2).

The Quick and the Dead

This morning i entered a small short trade on WAG. It began going against me around noon. My level was okay but the trade wasn’t working for me. Now instead of cutting the trade off what did i do? I added to my position bringing my cost down, okay. I would have ended flat on my position had i exited at that point but i proceeded to fumble through my order execution. When i exited i was back at the high of my original position but now i was overweight which meant a loss of my P & L. I covered the whole position at a bigger loss. This really puts a blemish on an otherwise very successful day for me trading my account. The truth is that i was wrong for adding into a position that should have been closed out to begin with; Furthermore i was too slow on exiting. Although i don’t recommend the use of this market tactic, there is rarely a time when “never”or “always” apply to trading. The example today shows me that when i’m wrong i’m better off taking my first loss because it’s usually my smallest one. And for all you traders out there should you find yourself in my shoes at one time or another be quick or you may end up dead.

Mario Carcamo

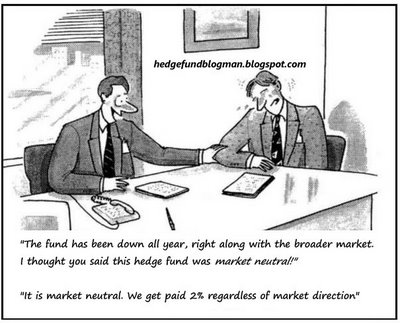

Hedge fund live vs. Hedge Funds

I want to know where my money is invested

Put us up against any other hedge fund and the one guarantee is our transparency. Four times a year, US securities regulators require fund managers to disclose their stock holdings. At hedge fund live, at any given time, your are able to view any of the traders portfolios, as well as watch the trading desk. I have mentioned this in a previous blog, that hedge fund live is truly innovative.

Mid day recap for Day Trade Well P&L is positive!

Control your emotions

Emotion can get the best of you when trading. It can cause you to exit a position to early, either by; not allowing you to let the losers play out or cutting your winners to soon. If you trade with emotion you will not be a successful trader. You must allow yourself to stay discplined and controlled and not base decision off your p&l. As I witnessed today,

Maintain your emotions

remaining calm and sticking to your strategy allows you to be successful.

CSCO

Last week, we sold CSCO at $21.99, for a profit of $240. While I can’t say we had any amazing insight into the next earnings report filed by Cisco on Friday, we did take a very disciplined approach to investing and sold when the stock hit our price target. Cisco reported drops in both earnings and gross margins that have contributed to its drop from $22 to its current level of about $18.70. In the long run, I still believe CSCO to be a good long term, value investment; however, due to the time constrained nature of the university desk investment fund, it is not likely to come back into CEF’s portfolio.

Summary of the first week

F430

I have always wondered what it is like to being a trader. As my first week comes to an end, I don’t own a Ferrari or a huge mansion. Is that not what Wall Street is? My first week has given me great exposure to the business and what a difficult one it is. There is a lot of pain that comes along with this job. You have to be able to stomach huge losses, but also not be greedy when things swing in your favor. I also learned that being prepared helps tremendously. The energy on the desk really gets you going and excited to be here.

I also realized that although I am a trader, there are other tasks that need to be done to help the business. The concept behind this site is truly remarkable. Some may say I am drinking the “kool aid”, but in all honestly, think about it- a fully transparent hedge fund, really? One of the biggest complaints about hedge funds is, how do I know what they are doing? Is this another Madoff scheme? What are they investing in? Well folks, here you have it! On top of that, the content that we can provide to viewers can help investors be successful traders from home.

There is still a lot for me to learn, but I am excited and can’t wait to share my success with you and hear about yours.

Have a Great Weekend!

-Justin Valle

The Way We Were: One Year Ago on Feb. 11, 2010

Let’s rewind back to exactly one year ago on Feb. 11, 2011 and see what our Chief Market Strategist Jeremy Klein had to say on that day:

“I could have been a Hero by 7 Cents!”

While most of my commentaries will surround market color with a corresponding opinion on direction, I will offer a bit of trading advice to those willing to listen. Ultimately, that may only be my mother, but if that is the case, so be it.

I would rate myself, on average, a B- trader. On good days, I may push it to a B+, but on bad ones, I would grade myself a C-. I am down P&L wise today. Small, to be sure, but when you come into the day on a winning streak, any loss is not tolerated. Alas, this is where I fall down the curve. Losses can and should be tolerated within the context of long term gains because without risk, there is no reward. Is it gnawing at me that I was short and was stopped out on the high tick in the S&P E-Minis at 1077.75? Of course, but that is the bet I made, and I lost. The B+ trader in me would have gotten back into the short once I saw signs of weakening momentum thanks to the XLF’s not being able to convincingly break above $14.00. Instead, I wallow in my misery knowing my print will most likely be staring right back at me tomorrow in The Wall Street Journal as today’s high.

In my mind, I play out how I could have been hero if it were not for that one tick that caused me to lose my short. I often hear similar refrains from our freshman traders who might blurt out while kicking the dirt after a down day “I could have been a hero by 7 cents!” Trading desks don’t need heroes. Instead, they need money makers who can recognize that when a 5 day winning streak is snapped, at least it is done with a day smaller in P&L drawdown than all of the previous days’ winners. It is the B+ trader in me that is going to focus on that fact.

___________________________________________________

Where we were then:

S&P Futures

Open: 1063.50

High: 1078.00

Low: 1057.50

Close: 1076.50

Where we are now:

S&P Futures

Last: 1327.25

Recent Comments